Water damage strikes when you least expect it. One minute you’re going about water damage insurance claims Melbourne in your day, the next you’re standing in ankle-deep water wondering how on earth you’re going to fix this mess.” This is what it should be “Water damage strikes when you least expect it. One minute you’re going about your day, the next you’re standing in ankle-deep water wondering how on earth you’re going to fix this mess.

At The Squeaky Clean Team, we’ve helped thousands of Melbourne families navigate water damage restoration over our 17+ years in business. We’ve worked alongside insurance assessors, loss adjusters, and claims managers. We know exactly what insurers need to see, and more importantly, we know how to help you get the coverage you deserve.

This guide walks you through everything you need to know about water damage insurance claims. We’ll help you understand what’s covered, what’s not, and how to maximize your claim outcome.

What Water Damage Is Actually Covered by Insurance?

Here’s the truth: not all water damage is created equal in the eyes of insurance companies. Understanding these distinctions can save you thousands of dollars and weeks of frustration.

Usually Covered (Good News!)

Most Australian home insurance policies cover what’s called “sudden and accidental” water damage. This includes:

Burst Pipes and Plumbing Failures

When a pipe bursts unexpectedly, you’re typically covered. This includes hot water systems failing, washing machine hoses bursting, and toilet cisterns cracking. The key word here is “sudden” – if the pipe has been leaking slowly for months, that’s a different story.

Appliance Overflows

Your dishwasher flooding the kitchen? Washing machine going rogue? These accidental overflows are generally covered under the “escape of liquid” category in your policy.

Storm and Rainwater Damage

Heavy Melbourne rain that comes through your roof or windows is usually covered. This also includes rainwater runoff – when water pools on normally dry ground and enters your home.

Accidental Damage from Household Activities

Someone knocks over a fish tank, or you accidentally leave the bath running – these mishaps are typically covered under most comprehensive policies.

The Grey Area (Check Your Policy!)

Flood Damage

This is where it gets tricky. Since 2012, Australian insurers use a standard definition of flood: water that escapes from rivers, creeks, lakes, or dams. Many policies now include flood cover as standard, but not all do. Some Melbourne areas are high-risk for flooding, which can affect both availability and cost.

After recent flooding events across Australia, major insurers like Allianz have started including flood cover as standard on new policies from January 2025. But if you have an older policy or specifically opted out of flood cover, you might not be protected.

Storm Surge vs. Flood

Storm surge (water pushed onto land by strong winds during a storm) may be covered differently than flood. Check your Product Disclosure Statement (PDS) to understand the distinction.

Usually NOT Covered (Important to Know)

Gradual Damage and Neglect

Here’s where many claims get rejected. If water damage results from long-term neglect or poor maintenance, insurers typically won’t pay. Examples include:

- Slow leaks you ignored for months

- Damage from deteriorating, rusted pipes you knew about

- Water damage from roofs that needed repair but weren’t maintained

- Issues arising from blocked gutters or damaged drainage

Pre-existing Damage

If your property already had water damage that wasn’t repaired, and new water damage occurs, your claim may be rejected or only partially covered.

Lack of Proper Maintenance

Insurance companies expect homeowners to maintain their properties. If your gutters are filled with leaves, your roof tiles are loose, or your flexi-hoses are visibly corroded, you might struggle to claim.

A recent study found that one in ten Australian home water damage claims comes from burst flexi-hoses – those flexible pipes under your sink. The average claim costs over $27,500, yet prevention is simple: check them every six months for signs of wear.

Understanding Water Damage Restoration Costs

Before diving into the claims process, it’s helpful to understand what you might be facing financially.

Water damage restoration costs vary dramatically based on several factors:

Size and Extent of Damage

A small bathroom leak might cost $500-$2,000 to fix. Major flooding affecting multiple rooms and requiring structural repairs can easily exceed $10,000.

Type of Water Involved

We classify water damage into three categories:

- Category 1 (Clean Water): From sources like burst supply pipes or rainwater. Relatively safe but still requires prompt extraction and drying.

- Category 2 (Grey Water): From appliances like dishwashers or washing machines. Contains some contaminants.

- Category 3 (Black Water): Sewage or flood water from outside sources. Requires extensive sanitization and often material replacement.

Black water restoration costs significantly more because it’s hazardous and requires specialized treatment.

Materials Affected

Carpet and drywall dry relatively quickly. Hardwood flooring, concrete, and structural timber take much longer and cost more to properly restore. Dense materials like concrete can take 5-7 days to completely dry.

Response Time

Here’s a critical point: the faster you respond, the less you’ll pay overall. Water damage that sits for 24-48 hours allows mold to begin growing. After 72 hours, you’re looking at potential structural damage and much higher restoration costs.

This is why our team at The Squeaky Clean Team responds within 60 minutes across Melbourne. Every hour counts when water is spreading through your property.

How to File a Water Damage Insurance Claims Melbourne: Step-by-Step

You’ve discovered water damage. Now what? Follow these steps to maximize your chances of a successful claim.

Step 1: Stop the Water Source (If Safe)

Your first priority is stopping more water from entering your property. Turn off the main water supply if it’s a plumbing issue. Put buckets under active leaks. If it’s safe to do so, remove items from the affected area.

Don’t put yourself at risk. If there’s an electrical hazard or contaminated water, wait for professionals.

Step 2: Call Professional Water Damage Restoration Experts IMMEDIATELY

Here’s where many homeowners make a critical mistake: they call their insurance company first and wait. Meanwhile, water continues spreading through their property, causing more damage by the hour.

Don’t wait on hold with your insurer while water destroys your home.

Your first call should be to a professional water damage restoration team. Here’s why:

Time Is More Critical Than Paperwork

Every hour water sits in your property, damage spreads. Carpets become unsalvageable. Water soaks deeper into walls and flooring. Mold begins growing within 24-48 hours. Waiting three days for your insurance company to organize a restoration team could mean thousands in additional damage that could have been prevented.

You Have a Duty to Mitigate

Your insurance policy actually requires you to take immediate action to prevent further damage. Calling professionals right away isn’t just smart – it’s what insurers expect you to do.

Professional Teams Handle the Insurance Process

At The Squeaky Clean Team, we don’t just dry your property. We guide you through the entire claims process:

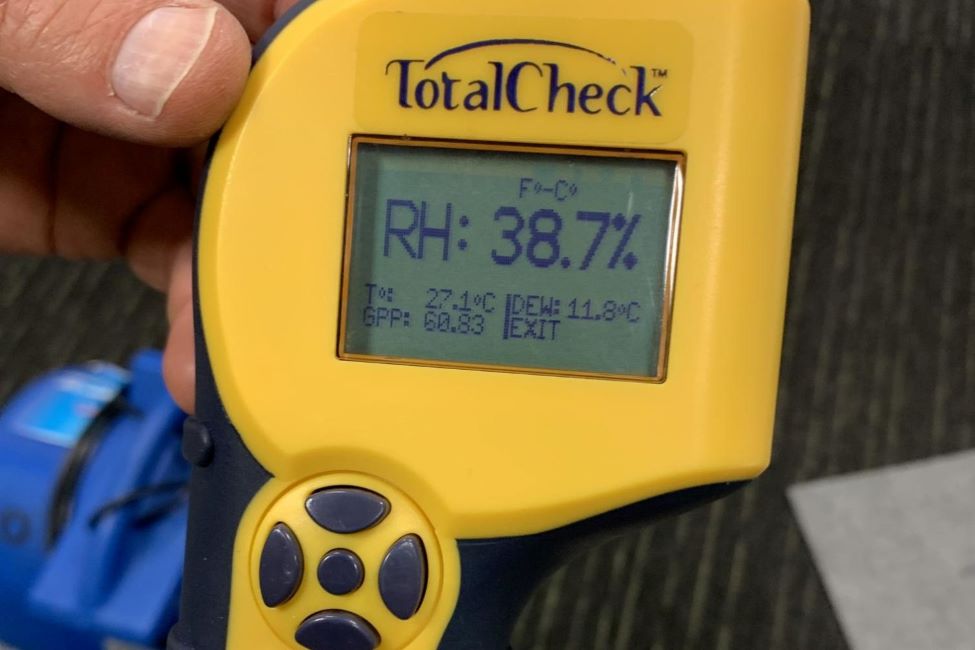

- We document everything properly with photos, moisture readings, and detailed reports

- We provide insurer-ready assessments and quotes

- We communicate directly with your insurance company on your behalf

- We know exactly what documentation insurers need

- We can often arrange direct billing, so you only pay your excess

When you call us at 1300 682 563, we arrive within 60 minutes and immediately begin damage mitigation. While our technicians are extracting water and setting up drying equipment, we’ll walk you through what information to give your insurer and when to call them.

Step 3: Document Everything As Work Begins

While our team starts the emergency restoration, documentation happens simultaneously:

- We take professional photos and videos from multiple angles

- We capture thermal imaging showing moisture spread

- We document the water source and extent of damage

- We record initial moisture readings

- We photograph damaged contents before moving them

This documentation becomes part of your insurance claim file. You get copies of everything.

Step 4: Contact Your Insurance Company (With Our Guidance)

Once emergency mitigation has started, then you notify your insurer. We’ll tell you exactly what information they need:

- Your policy number

- Clear details about what happened and when

- Our professional assessment and initial findings

- Photos and documentation we’ve already gathered

Many of our clients call their insurer while we’re on-site, so we can provide immediate professional input if needed.

When you call:

- Get a claim reference number

- Ask about your excess amount

- Confirm they’ve received our documentation

- Ask about timeframes for assessment

Step 5: We Continue Restoration While Managing Your Claim

Here’s the advantage of working with The Squeaky Clean Team:

We Don’t Stop for Insurance Delays

While some homeowners wait days for insurance approval, we’re already restoring your property. Our industrial dehumidifiers are running. Water is being extracted. Moisture levels are being monitored. We’re preventing the secondary damage that costs you more money.

We Provide Complete Claims Support

Our role goes far beyond drying your property:

- We create detailed, insurer-ready documentation

- We provide itemized quotes in the format insurers require

- We communicate directly with assessors and loss adjusters

- We explain the claims process in plain English

- We advocate for complete and proper restoration

We Work With All Major Insurers

Over 17 years, we’ve built relationships with AAMI, RACV, QBE, Allianz, YOUI, Budget Direct, and others. We understand their specific requirements and can often arrange direct billing.

Industry Standards That Insurers Trust

Our IICRC-certified technicians follow protocols that insurance companies recognize and accept. When we say your property is dry and mold-free, assessors trust our professional judgment.

Step 6: Meet with the Insurance Assessor

Your insurer will likely send an assessor or loss adjuster to inspect the damage. This is an important meeting.

Tips for the assessment:

- Be present during the inspection

- Point out all affected areas

- Show your documentation

- Ask questions about what’s covered

- Get timeframes for their decision

Having a professional restoration report ready for this meeting strengthens your position significantly.

Step 7: Review the Settlement Offer

Once the assessment is complete, your insurer will make an offer. Review it carefully:

- Does it cover all damaged items?

- Is the repair estimate reasonable?

- Are there any exclusions you weren’t expecting?

- Does it include temporary accommodation if needed?

If something doesn’t seem right, you have the right to question it. Professional restoration companies can provide second opinions on repair scopes and costs.

Step 8: Keep Detailed Records Throughout

Maintain a claim file with:

- All correspondence with your insurer

- Receipts for emergency repairs and accommodation

- Your restoration company’s invoices

- Photos and videos

- Moisture readings and drying logs

- Any additional expenses incurred

This documentation protects you if there are disputes later.

The Cost of Delay: Why Immediate Action Matters

Let’s be clear about what happens when you wait:

Hour 1-24: Water Spreads

Water doesn’t stay put. It spreads through carpets, soaks into walls, seeps under flooring. What started as damage in one room becomes damage in three rooms.

Hour 24-48: Mold Begins

Mold spores are everywhere. Give them moisture and 24-48 hours, and they start growing. Once established, mold remediation adds thousands to your restoration costs.

Hour 48-72: Structural Damage Accelerates

Water saturating timber frames, drywall, and concrete causes swelling, warping, and deterioration. Materials that could have been saved with quick drying now need replacement.

Day 3+: Insurance Complications

When assessors see extensive mold growth or structural damage, they start asking: “Why didn’t you act sooner to prevent this?” Delays can actually complicate your claim.

The Real Cost

A burst pipe that could have been a $2,000 restoration becomes a $10,000+ rebuild. The three days you waited for insurance approval cost you thousands in additional damage – and weeks more inconvenience.

This is why we tell every Melbourne homeowner: Don’t wait. Act now. We’ll handle the insurance paperwork.

Common Insurance Claim Mistakes to Avoid

After helping Melbourne families through thousands of water damage situations, we’ve seen these mistakes repeatedly:

Mistake #1: Calling Insurance Before Calling Restoration

The biggest mistake. Your home is being damaged while you’re on hold. Call professionals first, insurance second.

Waiting Too Long to Report

Some homeowners try to “fix it themselves” before calling the insurer. This can void your coverage. Report immediately, even if you’re not sure whether to claim.

Not Reading Your PDS

Your Product Disclosure Statement explains exactly what’s covered. Many claim rejections happen because people assumed they had coverage they didn’t.

Throwing Out Damaged Items

Keep everything until your assessor has seen it. Yes, it’s unpleasant, but you need proof of loss.

Accepting Poor Quality Repairs

The cheapest quote isn’t always the best. Substandard restoration work can lead to mold growth and ongoing problems that won’t be covered later.

Not Understanding Your Excess

Know how much you’ll need to pay. Sometimes small claims cost less than your excess, making them not worth claiming.

How The Squeaky Clean Team Makes Insurance Claims Easy

We’ve refined our approach over 17 years to make the entire process as stress-free as possible for Melbourne homeowners.

Our Swift Action Protocol

Within 60 Minutes:

Our team arrives at your Melbourne property with industrial-grade equipment ready to go.

Immediate Assessment:

We identify the water source, assess damage extent, and begin emergency mitigation – all before paperwork discussions.

While We Work:

As water extraction and drying equipment are deployed, we walk you through the insurance notification process. You make one call to your insurer with our guidance, armed with professional information they need.

Complete Documentation Package

We provide everything your insurer requires:

- Professional photography and thermal imaging

- Detailed moisture mapping and readings

- Comprehensive damage assessment reports

- Itemized restoration quotes

- Daily monitoring logs during the drying process

This documentation is prepared for your insurance claim, in the format assessors expect to see.

Claims Management Support

We Speak Insurance

After thousands of claims, we know what each major insurer needs. We translate technical restoration information into insurance language.

Direct Assessor Communication

With your permission, we handle conversations with loss adjusters and assessors directly. We present our findings professionally and advocate for complete, proper restoration.

No Surprises

We explain your likely out-of-pocket costs upfront. In most cases with legitimate claims, you’ll only pay your excess. We arrange direct billing whenever possible.

Why Our Approach Works Better

Prevents Additional Damage:

Our immediate response stops water damage from escalating. Less total damage means lower claim amounts and faster resolution.

Faster Insurance Approval:

Professional documentation and our reputation with insurers speeds up the approval process. Assessors trust our work.

One Team, Complete Service:

You’re not juggling multiple contractors. We handle emergency response, complete restoration, and insurance coordination all under one roof.

Proven Results:

Over 5,000 Melbourne properties restored, all remaining mold-free. Our track record speaks for itself.

What Makes Water Damage Claims Different in Melbourne

Melbourne’s unique climate and building styles create specific challenges:

Melbourne Weather Patterns

Our city experiences sudden flash flooding, particularly in lower-lying suburbs. Knowing your flood risk and having appropriate coverage is essential.

Older Housing Stock

Many Melbourne homes feature period architecture with unique materials. Restoration requires specialized knowledge to maintain heritage features while meeting modern standards.

Seasonal Considerations

Melbourne humidity affects drying times. High humidity days slow the drying process, while dry conditions accelerate it. Professional restoration accounts for these variables.

Local Building Requirements

We understand Melbourne council requirements and local building codes, ensuring restoration work meets all necessary standards.

Types of Water Damage We Commonly See in Melbourne

Understanding the different types of water damage helps you recognize what you’re dealing with:

Burst Pipes

Extremely common in Melbourne, especially during winter. Rapid response prevents thousands in additional damage.

Appliance Failures

Hot water systems, washing machines, and dishwashers cause frequent water damage events.

Storm Damage

Heavy rainfall overwhelming gutters or finding its way through roof spaces.

Flash Flooding

Melbourne’s urban landscape and drainage systems can be overwhelmed during intense rain events.

Sewage Backups

The most hazardous type, requiring immediate professional intervention.

Prevention: The Best Insurance Policy

While insurance provides financial protection, preventing water damage is always preferable:

Regular Maintenance Checks

- Inspect flexi-hoses every six months

- Clean gutters twice yearly

- Check roof tiles after storms

- Service hot water systems annually

- Test your main water shut-off valve

Know Your Property

- Understand where your water main shut-off is located

- Know which areas are most vulnerable

- Identify early warning signs of leaks

Consider Upgrades

- Replace old flexi-hoses proactively

- Install water leak detection systems

- Upgrade aging plumbing before it fails

Quick Action Saves Money and Stress

Here’s what you need to remember: immediate action prevents thousands in additional damage and weeks of unnecessary delays.

The sequence matters:

- Stop the water source (if safe)

- Call The Squeaky Clean Team at 1300 682 563

- We start emergency mitigation within 60 minutes

- We guide you through notifying your insurer

- We manage the restoration and claims process together

Don’t let insurance paperwork delay the critical first hours. We handle both – swift emergency response and complete claims support.

Get Help Now

If you’re currently dealing with water damage in Melbourne, every minute counts. Don’t spend time on hold with your insurer while water spreads through your property.

Call The Squeaky Clean Team now at 1300 682 563.

We’ll be at your property within 60 minutes to begin immediate damage mitigation. While we’re extracting water and setting up professional drying equipment, we’ll walk you through exactly what to tell your insurance company and when.

Our 110% Care Factor means we don’t just restore your property – we guide you through every step of the insurance process, remove the stress, and advocate for you to get the coverage you deserve.

For more information about our services, visit our water damage restoration page or learn about our residential flood damage restoration services.